Tax fraud is on the rise In recent years, incidents of tax fraud have risen dramatically due to the ease with which criminals can obtain…

Anyone that is e-filing 1099-MISC forms this year, you’ll have to wait until Feb 3rd to get your confirmations. According the the IRS as of

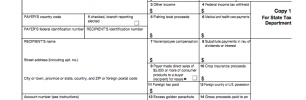

Businesses must provide a Form 1099-MISC to recipients by January 31, 2014. The due date for providing Form 1099-MISC to recipients if amounts are reported…

Recently, this question appeared on LinkedIn: What’s the benefit of hiring a W2 versus hiring a 1099 consultant for the same job? I’m interested in…

You might have a hard time finding 2012 1099-MISC forms from your local office supply store, but we can help. The service providers at WageFiling…

2013 1099-MISC Filing Deadlines Here are the dates for paper and electronic filing for breitling 1099-MISC forms for 2013. If you need help filing check out…

A question business owners have each year when it comes time to file 1099-MISC forms is who get’s one? Who falls under the guideline of…

byreplicawatches.com

Discover the “Betaalbaar En Praktisch iphone 15 Pro Max Hoesje,” designed for those who seek both affordability and functionality. This stylish case offers robust protection while maintaining a sleek profile, making it perfect for everyday use. With precise cutouts for easy access to buttons and ports, the iphone 15 pro max hoesjes ensure your device remains safe without compromising on style. Now available for those who value practicality in their phone accessories.